What is Tax Deductibility?

Tax deductibility refers to the ability to subtract certain expenses from your taxable income, thereby reducing the amount of tax you owe. The concept is a cornerstone of tax law, designed to provide relief for specific types of expenditures that meet certain criteria. These deductions can range from business expenses to medical costs, and understanding which expenses qualify is crucial for minimizing your tax liability. Proper understanding of tax deductibility allows individuals and businesses to take full advantage of the tax system and ensure they are not overpaying.

Defining Tax Deductibility

Tax deductibility means that you can reduce your gross income by the amount of the expense. This reduction in taxable income directly translates to lower tax payments. The goal is to provide a tax benefit for expenses that are deemed necessary or beneficial to the taxpayer. For instance, certain medical expenses, charitable contributions, and business costs can be deducted, lowering the overall tax burden. Each deduction is governed by specific rules and limitations set by the tax authorities, such as the IRS in the United States.

Deductible vs Non-Deductible Expenses

Not all expenses qualify for tax deductions. Deductible expenses are those the tax code specifically allows you to subtract from your gross income. These often relate to business, medical, or charitable activities. Non-deductible expenses, on the other hand, are personal costs that cannot be used to reduce your taxable income. Examples of non-deductible expenses include personal entertainment, certain lifestyle choices, and, in many cases, cosmetic procedures that are not deemed medically necessary. Understanding the difference is critical for accurate tax reporting and compliance.

Can Teeth Whitening Be Deducted?

Whether teeth whitening is tax-deductible depends primarily on whether it qualifies as a medical expense. The IRS allows deductions for medical expenses exceeding 7.5% of your adjusted gross income (AGI). If teeth whitening is performed for cosmetic reasons alone, it’s generally considered a non-deductible expense. However, if the teeth whitening is part of a broader medical treatment or is deemed necessary for a medical condition, it might be eligible for a deduction. It’s essential to carefully evaluate the specific circumstances and consult with a tax professional to make an accurate determination.

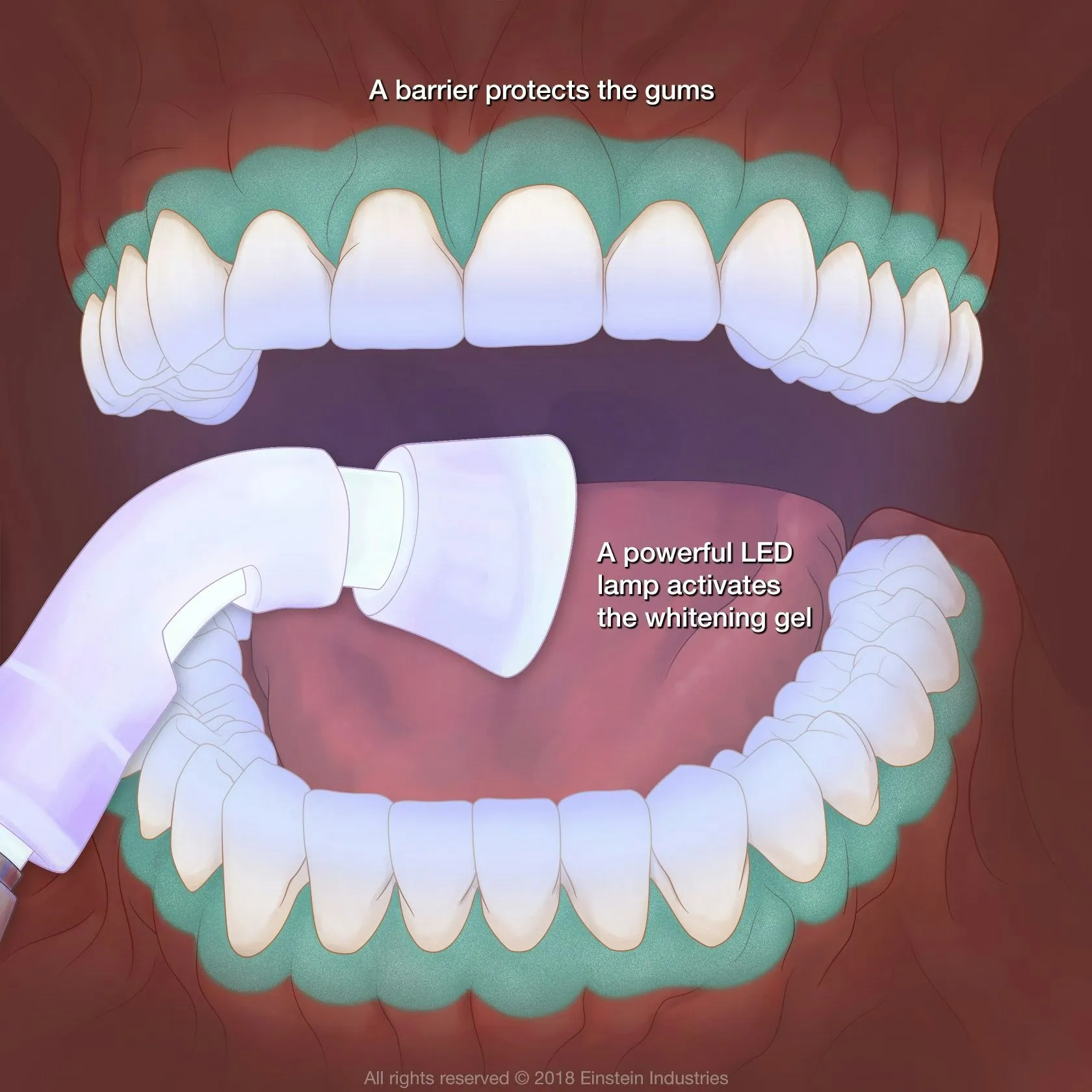

When is Teeth Whitening a Medical Expense?

Teeth whitening is more likely to be considered a medical expense if it’s performed as part of a treatment for a documented medical condition. This could include cases where teeth discoloration is a side effect of a medical treatment or medication, or when whitening is part of a restorative dental procedure. In such situations, the procedure may be seen as medically necessary to restore oral health or address a health-related issue. Medical necessity must be supported by documentation from a healthcare provider, which is crucial for claiming the deduction.

The 5 Facts About Deducting Teeth Whitening

Fact 1 Medical Necessity

To claim teeth whitening as a medical expense, it must be considered medically necessary. This means a qualified healthcare professional must determine that the procedure is essential for treating a medical condition or alleviating a health issue. Cosmetic teeth whitening, done purely for aesthetic purposes, typically doesn’t meet this criterion. The presence of a medical reason significantly increases the likelihood of a tax deduction.

Fact 2 Documentation Requirements

Detailed documentation is crucial when claiming a medical expense deduction. You must keep records of all expenses related to teeth whitening, including receipts, invoices, and any supporting medical reports. This documentation should clearly state the purpose of the treatment and confirm its medical necessity. Proper documentation is essential for substantiating your claim and avoiding potential issues during an IRS audit.

Fact 3 Itemized Deductions

Medical expense deductions can only be claimed if you itemize deductions on Schedule A (Form 1040). You must itemize instead of taking the standard deduction. Itemizing involves listing various deductible expenses, including medical costs, to arrive at your total itemized deductions. The amount of medical expenses you can deduct is limited to the amount exceeding 7.5% of your adjusted gross income. This threshold applies to all medical expenses combined, not just teeth whitening.

Fact 4 Limits on Deductions

There are limits on the amount of medical expenses you can deduct. You can only deduct the portion of your medical expenses that exceeds 7.5% of your AGI. This threshold applies to all medical expenses combined. It’s important to calculate your AGI accurately and determine if your total medical expenses are above the threshold to qualify for the deduction. Keep in mind that only the amount exceeding the threshold is deductible, so careful calculation is required.

Fact 5 Professional Advice

Consulting a tax professional or a certified public accountant (CPA) is highly recommended when considering deductions for teeth whitening. Tax laws can be complex, and professional advice ensures you understand the regulations and maximize your deductions within the legal framework. A tax professional can help you gather the necessary documentation, interpret IRS guidelines, and ensure your claim is accurate and compliant. Their expertise can prevent costly errors and potential audits.

How to Claim Teeth Whitening as a Deduction

Gathering Relevant Documents

Start by gathering all necessary documents, including receipts, invoices, and medical reports related to the teeth whitening procedure. These documents should clearly state the date of service, the type of service performed, and the amount paid. If your teeth whitening was part of a larger dental treatment, ensure you have documentation supporting the medical necessity of the procedure. Keep all these records organized and easily accessible for your tax filing.

Understanding IRS Guidelines

Familiarize yourself with IRS guidelines on medical expense deductions. IRS Publication 502 provides detailed information on what qualifies as a medical expense and how to calculate the deduction. Understand the 7.5% AGI threshold and how to apply it to your total medical expenses. Knowing the rules and regulations ensures you are filing your taxes correctly and minimizes the risk of errors or issues.

Consulting a Tax Professional

Seek professional advice from a tax advisor or CPA. They can review your documentation, assess your eligibility for the deduction, and guide you through the process of claiming the expense. A professional can help you navigate the complexities of tax laws and ensure your claim is accurate and compliant. This step is crucial for maximizing your potential deductions and avoiding potential penalties.

Alternative Healthcare Options

Besides teeth whitening, various other dental and medical procedures are often tax-deductible. These include essential treatments like fillings, crowns, and root canals, which are performed for the purpose of health. Also, consider if you’re eligible for other medical expenses such as vision or hearing related care. Checking your eligibility and documentation will allow you to ensure that you are getting the most out of the tax return season.

Dental Procedures and Tax Benefits

Certain dental procedures are generally considered eligible for medical expense deductions, including treatments to address oral health issues and those that are essential for maintaining overall health. These include fillings, root canals, and other treatments performed to repair or restore dental function. These costs can be added to your total medical expenses, and you can deduct the amount exceeding 7.5% of your AGI, provided you itemize deductions.

Preventive Dental Care and Tax Implications

Regular preventive dental care, such as check-ups and cleanings, is also considered an eligible medical expense for tax purposes. This includes the costs associated with exams, X-rays, and routine cleanings. These preventive measures are essential for maintaining good oral health and preventing the need for more extensive and costly treatments down the line. The costs related to preventive care can be added to your overall medical expenses when calculating your potential deduction.